What Is a Reverse Mortgage and Is It Right for Homeowners Over 55 in BC?

Living in British Columbia, particularly in the vibrant communities of Vancouver and the Lower Mainland, comes with a unique set of financial realities. We live in one of the most beautiful places on earth, but also one of the most expensive. For many homeowners aged 55 and older, this creates a common paradox: you are "house rich" due to rising property values, but you might feel "cash poor" when it comes to monthly retirement income.

If you have built up significant equity in your home but don't want to sell the property you love, a reverse mortgage might be the solution you’ve been looking for. But how exactly does it work, and is it the right financial move for your retirement?

As a native Vancouverite and a mortgage broker with over 15 years of experience, I have helped countless locals navigate these decisions. In this guide, we will break down everything you need to know about reverse mortgages in BC, how to access your home equity tax-free, and whether this strategy aligns with your long-term goals.

Understanding the Basics: What Is a Reverse Mortgage?

A reverse mortgage is a financial product designed specifically for homeowners aged 55 or older. Unlike a traditional mortgage where you make monthly payments to a lender to pay down your debt, a reverse mortgage allows you to borrow money against the equity of your home without the requirement of monthly mortgage payments.

Here is the key difference: instead of you paying the bank, the bank pays you. You can receive the funds as a lump sum, a stream of regular income, or a combination of both. The loan, plus the accrued interest, is only repaid when you sell the home, move out, or pass away.

Key Features of a Reverse Mortgage in Canada

No Monthly Payments: You are not required to pay principal or interest as long as you live in the home.

Tax-Free Cash: The money you receive is a loan, not income, so it is generally not taxable and does not affect Old Age Security (OAS) or Guaranteed Income Supplement (GIS) benefits.

Ownership Retention: You remain the owner of your home. You are simply leveraging the asset you have built over decades.

How Does a Reverse Mortgage Work in Vancouver, BC?

In Vancouver's real estate market, where property values have appreciated significantly over the last few decades, a reverse mortgage can unlock a substantial amount of capital. Lenders typically allow you to access up to 55% of your home's value, though the exact amount depends on your age, the property type, and its location.

For example, if you own a home in North Vancouver or the West Side valued at $2 million, accessing even a small percentage of that equity can provide a massive safety net for retirement, fund home renovations to help you age in place, or help grandchildren with a down payment on their own property.

However, qualification isn't just about the house. As your Mortgage Broker in Vancouver, I help ensure you meet the specific criteria:

All homeowners on the title must be at least 55 years old.

The home must be your primary residence.

Any existing mortgage or secured debt must be paid off with the reverse mortgage funds (the remaining funds go to you).

The "No Negative Equity Guarantee"

One of the biggest fears seniors have is passing debt on to their children. It is vital to understand that reverse mortgages in Canada, such as the CHIP Reverse Mortgage, come with a No Negative Equity Guarantee.

This means that as long as you meet your mortgage obligations (paying property taxes, home insurance, and maintaining the property), you will never owe more than the fair market value of your home at the time it is sold. Even if the housing market in BC were to decline significantly, your estate would not be burdened with the difference.

Pros and Cons: A Balanced Look

While accessing tax-free income sounds appealing, it is important to weigh the benefits against the costs. Here is a structured look at the advantages and disadvantages.

| Pros of a Reverse Mortgage | Cons of a Reverse Mortgage |

| Cash Flow: Eliminates monthly mortgage payments and provides extra income. | Higher Interest Rates: Rates are typically higher than traditional mortgages or HELOCs. |

| Stay in Your Home: No need to downsize or move away from your community. | Equity Erosion: Interest accumulates over time, reducing the equity left for your heirs. |

| Tax Efficiency: Funds are tax-free and don't trigger income tax clawbacks. | Setup Costs: There are appraisal fees, legal fees, and administrative costs to set it up. |

| Flexibility: Use the money for anything—travel, debt consolidation, or healthcare. | Prepayment Penalties: Paying off the loan early can sometimes result in fees. |

Is a Reverse Mortgage Right for You?

Determining if this is the right path depends entirely on your financial picture and retirement goals. Through my consultations with clients across Vancouver, I often see reverse mortgages used effectively in the following scenarios:

1. Supplementing Retirement Income

If your pension is not quite covering the rising cost of living in BC, a reverse mortgage acts as a "top-up," allowing you to maintain your standard of living without stress.

2. Eliminating Monthly Debt Payments

Many seniors carry credit card debt or a small remaining mortgage balance. Using a reverse mortgage to pay these off frees up monthly cash flow immediately.

3. "Living Inheritance"

Rather than waiting to pass on wealth, many parents want to help their children enter the Vancouver housing market now. You can gift funds tax-free to help them with a down payment.

4. Aging in Place

Renovating a home to make it accessible (installing stairlifts, walk-in tubs, etc.) can be costly. Accessing equity allows you to modify your home so you can live there safely for years to come.

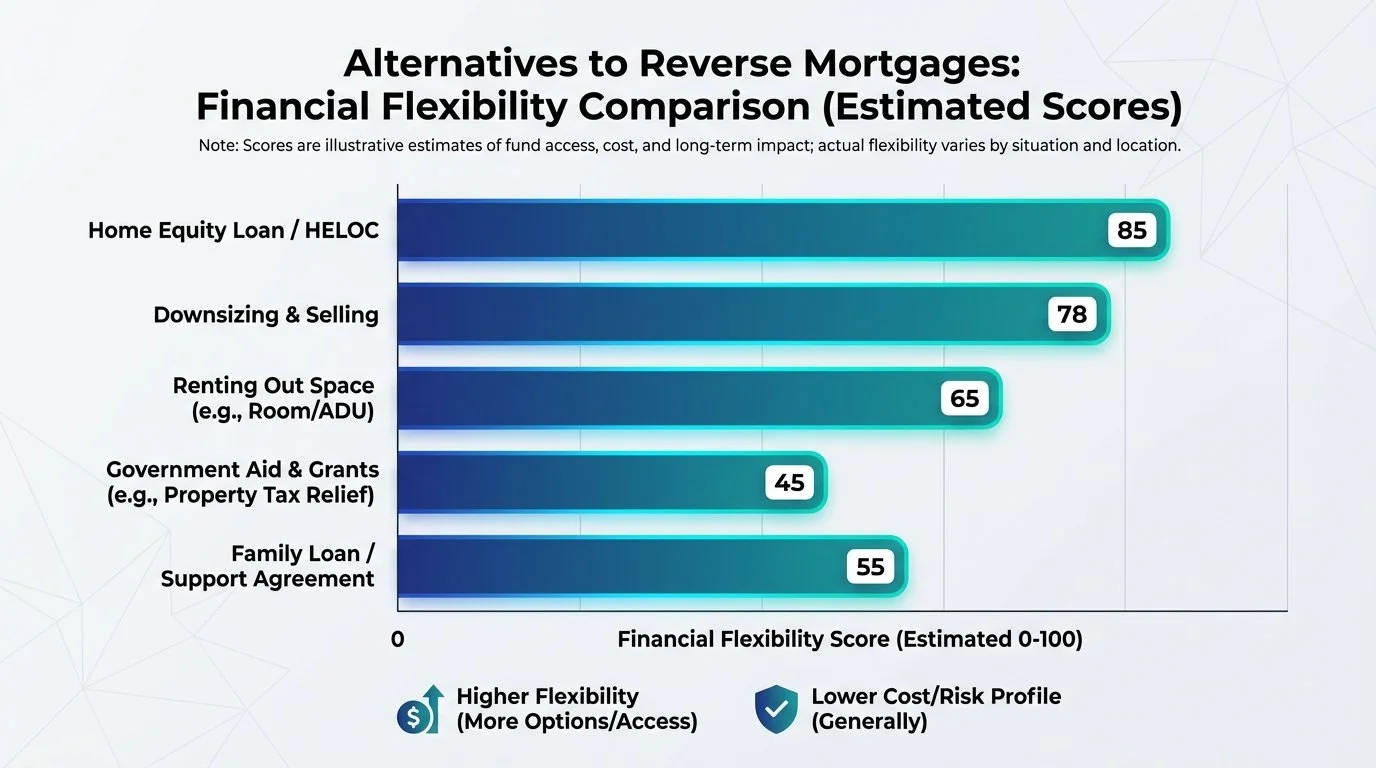

Alternatives to Reverse Mortgages

As an independent broker, my duty is to present you with all your options, not just one. Before committing, we should explore alternatives to ensure you are making the best choice.

Home Equity Line of Credit (HELOC)

If you have good credit and sufficient income to service monthly interest payments, a HELOC might offer a lower interest rate than a reverse mortgage. This is often a good option for those who can afford a small monthly bill.

Refinancing

If you have income (pension or employment), refinancing your current mortgage to extend the amortization period could lower your payments and free up cash, though it still requires monthly payments.

Downsizing

Selling your home and buying a smaller condo or moving to a less expensive area is the most direct way to access equity. However, this involves moving costs, real estate commissions, and the emotional toll of leaving a family home.

Private Lending

For short-term capital needs where traditional banks say "no," private mortgage lending might be a bridge solution, though it is generally not a long-term retirement strategy.

Why Work with a Vancouver Mortgage Broker?

You might be wondering, "Why not just go to my bank?" The reality is that most major banks have a limited menu of products. A reverse mortgage is a specialized product, and not all financial institutions offer them or understand the nuances of the CHIP program.

As your local mortgage expert, I work with over 50 lenders. I can compare the reverse mortgage options against traditional refinancing and private lending to give you an unbiased recommendation. Plus, I understand the local Vancouver market—from valuation trends to neighborhood specifics—which helps in getting your application approved smoothly.

If you are unsure about the numbers, you can start by using our Mortgage Calculator to get a rough idea of your current standing, but a personal conversation is always the most accurate way to assess your borrowing power.

Frequently Asked Questions (FAQs)

1. Will the bank own my home if I get a reverse mortgage?

No. You maintain full ownership and title of your home. The reverse mortgage is simply a loan secured against the property, just like a standard mortgage. You are required to live in the home, pay property taxes, and maintain insurance.

2. How much money can I get from a reverse mortgage in BC?

You can typically access up to 55% of your home's appraised value. The exact amount depends on your age (the older you are, the more you can access), the location of your home, and the type of property. Given Vancouver's high property values, this can be a significant sum.

3. What happens if I owe more than the house is worth?

This is covered by the "No Negative Equity Guarantee." As long as you have met your mortgage obligations, the lender guarantees that the amount you have to repay on the due date will not exceed the fair market value of your home. Your heirs will not be personally liable for any shortfall.

4. Can I lose my home with a reverse mortgage?

As long as you fulfill your obligations—keeping property taxes and insurance current, maintaining the property, and living in the home as your primary residence—you cannot be forced to move or sell, regardless of how much the loan balance grows.

5. Are there restrictions on how I use the money?

Generally, no. Once any existing debt secured by the home (like a previous mortgage) is paid off, the remaining funds are yours to use however you wish—be it for travel, medical expenses, home repairs, or gifting to family.

Ready to Explore Your Options?

Deciding to tap into your home equity is a major financial decision, and it’s not one you should make alone. Whether you are looking to fund a comfortable retirement, help your family, or simply eliminate financial stress, I am here to help you understand the fine print.

At Watts Mortgages, I provide honest, transparent advice tailored to your life in Vancouver. Let's review your situation, compare the numbers, and see if a reverse mortgage is the right tool for your retirement plan.

Don't leave your retirement to chance.

Contact Chad Watts today for a free, no-obligation consultation. Call me at 1-778-773-6631 or email chad@wattsmortgages.ca to get started.

Disclaimer: The content provided in this blog post is for informational purposes only and does not constitute financial or legal advice. Mortgage rates and qualification criteria are subject to change. Please consult with a professional mortgage broker to discuss your specific financial situation.