Mortgage Guide for Self-Employed Medical Professionals in Vancouver

Navigating Vancouver’s housing market as a self-employed doctor or dentist? Learn how tailored mortgage solutions, from A to B lending, can help medical professionals secure approval. Chad Watts of Watts Mortgages shares expert tips, insider strategies, and programs built for your unique income profile.

Case Studies: Self-Employed Medical Pros Succeeding in Vancouver Mortgages

Discover how self-employed medical professionals in Vancouver — from doctors to dentists — are securing homes and expanding practices despite income challenges. Explore real case studies, market trends for 2025, and expert mortgage strategies from Chad Watts at TMG The Mortgage Group.

Unlock Vancouver Home Equity This Christmas: Smart Holiday Financing Tips

Unlock the power of your Vancouver home equity this Christmas with smart financing strategies. From HELOCs to reverse mortgages, learn how to fund festive upgrades, support family, and invest wisely for the year ahead.

Case Studies in Trust: How Watts Mortgages Restores Confidence for Vancouver Clients Facing Mortgage Challenges

Discover how Watts Mortgages rebuilds consumer trust in Vancouver’s mortgage market through transparent guidance and personalized solutions. Real case studies show how we help clients overcome challenges like credit issues, renewals, and reverse mortgages with confidence.

Why Consumer Trust Matters: How Vancouver Mortgage Brokers Like Watts Mortgages Build Lasting Relationships

Trust is essential when choosing a Vancouver mortgage broker. Discover how Watts Mortgages builds lasting relationships through transparency, expertise, and personalized service in a complex market.

Debunking Down Payment Myths: How Watts Mortgages Helps Vancouver Buyers Go Solo

Think you need parental help for a down payment in Vancouver? Think again. Learn how Watts Mortgages helps buyers go solo with expert strategies and flexible financing.

Unlocking Homeownership in Vancouver: Strategies to Buy Without Parental Down Payment Help

Think you need parental help to buy in Vancouver? Think again. Learn smart, independent strategies—from incentives to creative financing—to unlock homeownership on your own.

Case Studies: How Vancouver Homeowners Are Beating the Longer Mortgage Process Odds

Vancouver's mortgage process is slower, but smart strategies can beat the odds. See real client wins and learn how Watts Mortgages helps you close faster—stress-free.

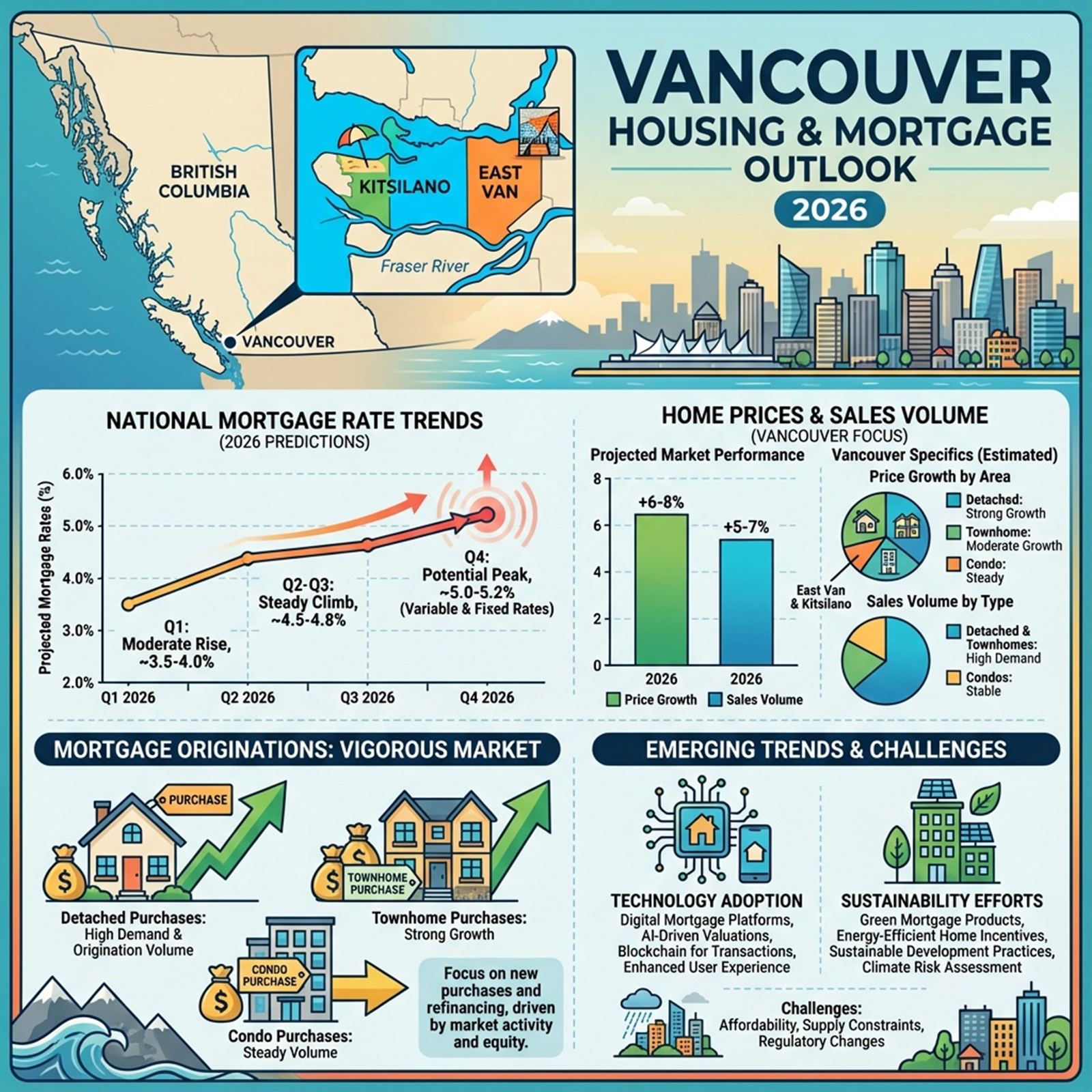

Why Is the Mortgage Process Getting Longer and Harder in Vancouver? A Comprehensive Guide

Mortgage approvals in Vancouver are taking longer due to new rules, rising rates, and lender caution. Learn what’s changed—and how to navigate it with confidence.

Client Success Stories: Navigating Home Purchases in Vancouver's Declining Market

See how buyers succeed in Vancouver’s declining market with smart mortgage solutions from Watts Mortgages.

Is It Safe to Buy a Home in Vancouver's Declining Market? A Comprehensive Guide

Learn how to buy safely in Vancouver’s declining housing market with expert mortgage tips from Chad Watts.

B.C.’s New Mortgage Services Act: What Vancouver Clients Need to Know This July

BC Mortgage Services Act 2025: How It Protects Vancouver Borrowers and Enhances Transparency

How B.C.’s “BC Builds” Rental Program Creates New Opportunities for Vancouver Home Buyers

Discover how the BC Builds program is transforming Vancouver’s housing market in 2025. Learn how increased rental supply benefits buyers and investors, and get expert mortgage advice from Chad Watts at TMG. Secure your move now!

Navigating the Spring Housing Market: Tips for First-Time Homebuyers

First-time homebuyer in Vancouver? Get expert spring market tips and mortgage advice to navigate the season with confidence and secure your dream home.

Vancouver Mortgage Broker Chad Watts: Helping Homeowners Navigate Interest Rate Changes

Is It Worth Working with an independent Mortgage Broker

Navigating Canada's 5-Year Fixed Mortgage Rates: Insights and Advice

Navigating Canada’s 5 year fixed rate mortgage rates

Understanding the Value of Real Estate Appraisals in Vancouver's Market

Understanding the Value of Real Estate appraisals in Vancouver’s Market.

The Essential Guide to "Subject to Financing" in Real Estate Offers

Subject to Financing Conditions and why they are important to you!

A Comprehensive Guide for First-Time Home Buyers in British Columbia: Understanding Property Transfer Tax and Exemptions

Understanding Property Transfer Tax and Exemptions