Can Rental Income Help You Qualify for a Larger Mortgage in British Columbia?

Living in British Columbia, particularly in the competitive real estate markets of Vancouver and the Lower Mainland, often requires creative financial strategies. As home prices remain high, many prospective homebuyers find themselves asking a critical question: How can I afford the home I want?

One of the most effective ways to boost your borrowing power is by leveraging rental income. Whether you are looking to buy a home with a basement suite (often called a "mortgage helper") or purchasing a dedicated investment property, the potential rent generated by that property can significantly impact your mortgage application.

As a Mortgage Broker in Vancouver, BC with over 15 years of experience, I have helped countless clients navigate these rules. In this comprehensive guide, we will explore how rental income works when qualifying for a mortgage in BC, the different calculation methods lenders use, and how you can use this strategy to secure the financing you need.

The "Mortgage Helper" Advantage in Vancouver

In the Greater Vancouver area, the concept of a "mortgage helper" is not just a bonus; for many, it is a necessity. A mortgage helper refers to a secondary suite within a principal residence—such as a basement apartment or a laneway house—that is rented out to tenants.

When you apply for a mortgage, lenders look at your Debt Service Ratios: the Gross Debt Service (GDS) and Total Debt Service (TDS). These ratios compare your income against your debt obligations. If your income is fixed but house prices are high, your ratios might exceed the allowable limits.

However, by factoring in rental income, you effectively increase your total household income in the eyes of the lender. This lowers your debt service ratios, allowing you to qualify for a larger mortgage amount than you could on your employment income alone.

How Lenders Calculate Rental Income: The Math Behind the Mortgage

It is important to understand that you cannot simply add 100% of the rent to your salary and hand it to the bank. Canadian lenders and mortgage insurers (like CMHC) have specific guidelines on how much rental income can be used. Generally, there are two primary methods lenders use to calculate this:

1. The 50% Add-to-Income Method

This is the most common method used by major banks and insurers. Lenders will take 50% of the gross rental income and add it to your total annual income for qualification purposes.

Why only 50%? Lenders assume that roughly half of the rental income will be used to cover vacancies, maintenance, taxes, and other landlord-related expenses.

The Result: Even at 50%, this addition can boost your borrowing power by tens of thousands of dollars.

2. The Rental Offset Method

Some lenders, particularly credit unions or specialized mortgage lenders, may use a "rental offset" calculation. This is often more favorable for investors or those buying properties with strong cash flow.

How it works: Instead of adding the income to your salary, the lender applies a percentage of the rental income directly against the mortgage payment and property expenses (taxes/heat) associated with the rental unit.

The Result: If the rent covers the costs, that debt is essentially "washed" from your application, meaning it doesn't negatively impact your debt ratios.

Comparison: How Calculation Methods Affect Qualification

Below is a simplified comparison to illustrate how these methods might look for a property generating $2,000/month in rental income.

| Calculation Method | How it Works | Impact on Application | Best For |

| 50% Add-to-Income | $1,000 (50% of $2,000) is added to your gross monthly income. | Increases total qualifying income. | First-time buyers with high personal income but high purchase price. |

| Rental Offset | Percentage of rent (e.g., 80%) is used to pay down the property debt in the calculation. | Reduces the liability associated with the property. | Real estate investors with multiple properties or high rental yield. |

To see how these numbers might look in your specific scenario, you can try plugging different mortgage amounts into my Mortgage Calculator to estimate your payments.

Legal Suites vs. Unauthorized Suites: Does It Matter?

A common concern among Vancouver homebuyers is the status of the suite. Does the suite need to be "legal" or "authorized" by the municipality for the income to count?

The Short Answer: Not always.

Many lenders in British Columbia recognize that "unauthorized" suites are a reality of the local market. As long as the appraiser confirms that the suite is self-contained (has its own entrance, kitchen, and bathroom) and adheres to safety standards (like fire separation), many lenders will still allow you to use the rental income for qualification.

However, there are distinctions:

Legal/Authorized Suites: You can typically use 100% of the allowable calculation (e.g., 50% of the income).

It should be noted that if you have an illegal suite the lender might be comfortable with the use of income but there is always the chance the local government may want it to become a legal suite down the road which can cost you money if you need to bring it into code if it finds itself outside of that.

Documentation You Will Need

If you plan to use rental income to qualify, be prepared to provide documentation. Lenders need proof that the income is real and sustainable. The documents required depend on whether you are buying a property that already has tenants or if you are buying a new rental.

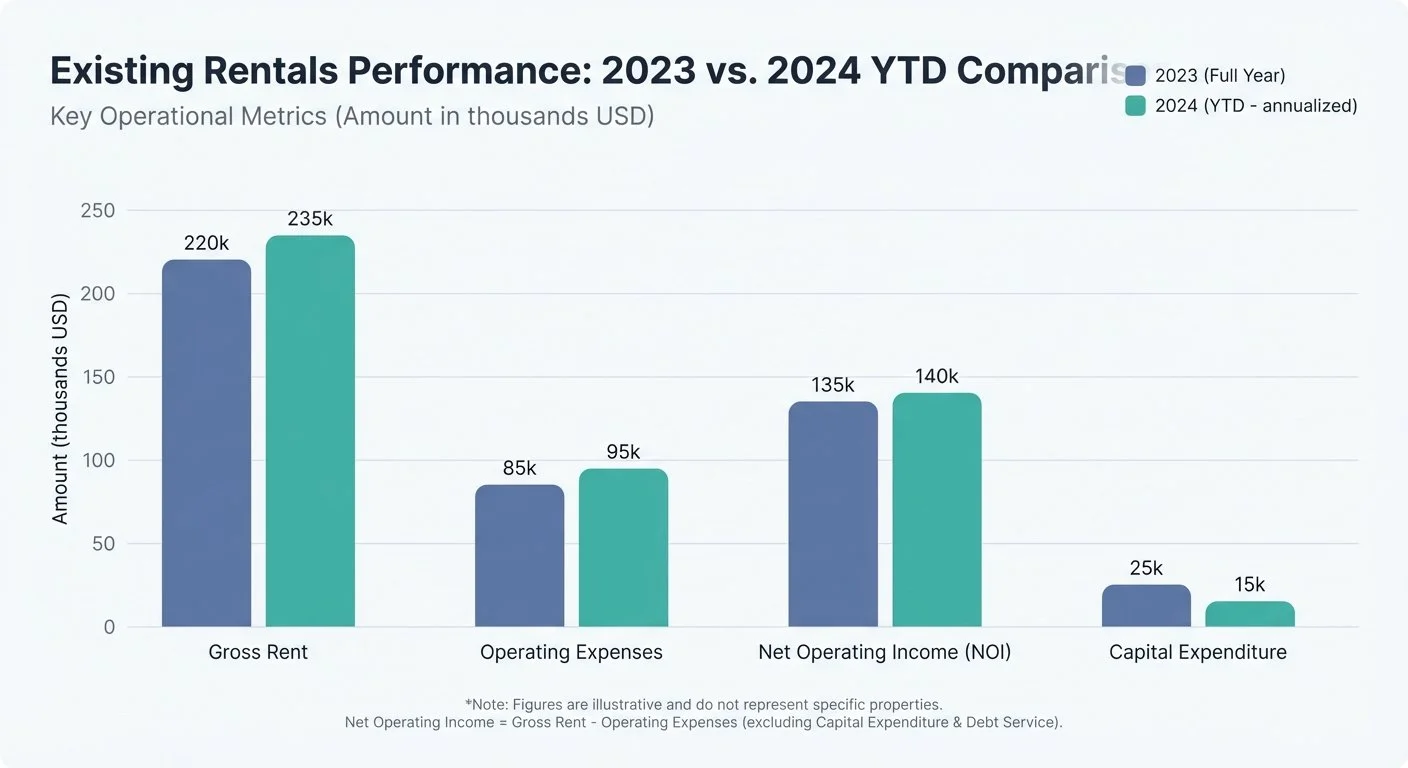

For Existing Rentals (Property you already own):

T1 General Tax Returns: To show rental income declared in previous years.

Lease Agreements: Current signed tenancy agreements.

Bank Statements: Proof of rent deposits entering your account. Typically 3 months of deposits

For New Purchases (Projected Income):

Schedule A / Market Rent Appraisal: An appraiser will evaluate the unit and estimate the fair market rent it can generate. Lenders will use this figure (or a percentage of it) for qualification.

Lease Assignment: If the property is currently tenanted, providing the existing lease helps.

Owner-Occupied vs. Investment Property

Owner-Occupied with a Suite

If you live in the main part of the house and rent out the basement, this is considered an "owner-occupied" purchase.

Minimum Down Payment: You can purchase with as little as 5% down (on the first $500k) if the purchase price is under $1 million.

Mortgage Insurance: High-ratio mortgages (less than 20% down) require CMHC, Sagen, or Canada Guaranty insurance. These insurers allow rental income to be used to help you qualify.

Pure Investment Property

If you do not plan to live in the property, it is classified as a rental/investment property.

Minimum Down Payment: You must put down at least 20%.

Qualification: Very few lenders may use the Rental Offset method more frequently here, which can be very powerful for building a portfolio.

For more details on navigating investment purchases, visit my page on Home-Rental Purchases in Vancouver.

Why Working with a Mortgage Broker is Crucial

When you walk into a major bank branch, you are often limited to their specific calculation methods. If their policy is strict on unauthorized suites or uses a conservative rental income calculation, you might be declined for the loan amount you need.

This is where I come in.

At Watts Mortgages, I work with over 50 different lenders, including major banks, credit unions, and trust companies. This access allows me to:

Shop for the Best Policy: I can find the lender whose rental income policies best match your specific situation.

Maximize Your Budget: By choosing a lender with more generous ratios, you might qualify for a house in a better neighborhood or with better potential for appreciation.

Save You Money: Best of all, my services are generally free to you (the lender pays me), and I can often secure better rates than what is posted at the bank.

Whether you are a first-time buyer needing a mortgage helper to break into the market, or an investor looking at private lending options for a fixer-upper, having an expert on your side makes all the difference.

Frequently Asked Questions (FAQs)

1. Can I use potential Airbnb or short-term rental income to qualify?

Generally, major lenders prefer long-term rental income (12-month leases) for qualification stability. While short-term rentals can be lucrative, the income is considered variable. However, some specialized lenders may consider a 2-year average of short-term rental income declared on your tax returns. Given BC's recent regulations on short-term rentals, it is vital to discuss this with a professional first.

2. Does the rental suite need to be legal for me to use the income?

No, not necessarily. Many lenders in BC will accept income from "non-conforming" or unauthorized suites, provided the appraiser confirms the unit is self-contained and safe. However, the percentage of income allowed might vary compared to a fully legal suite.

3. What if the suite is currently empty?

If the suite is vacant when you purchase the home, we can order a "Market Rent Appraisal." An appraiser will analyze the local rental market and determine what the unit should rent for. Lenders will then use this estimated figure to help you qualify.

4. How much down payment do I need for a home with a rental suite?

If you plan to live in one of the units (owner-occupied), you can buy with as little as 5% down on the first $500,000 and 10% on the remainder (up to a $999,999 purchase price). If the price is over $1 million, or if it is purely an investment property you won't live in, you need a minimum of 20% down.

5. Can I use rental income to qualify for a mortgage renewal or refinance?

Absolutely. If you are looking to renew or refinance your mortgage, rental income can help you qualify for better rates or access equity. You will typically need to provide current lease agreements and recent tax returns to verify the income history.

Ready to Maximize Your Purchasing Power?

Buying a home in Vancouver is a significant financial milestone, and using rental income is a smart strategy to make that dream a reality. Don't let strict bank policies limit your potential.

As your local mortgage expert with TMG The Mortgage Group, I am here to help you crunch the numbers, navigate the paperwork, and secure the best possible financing solution.

Let's find out exactly how much you can afford.

Schedule Your Free Consultation Today

Or, feel free to call me directly at (778) 773-6631 or email chad@wattsmortgages.ca. I look forward to helping you navigate the BC housing market with confidence.